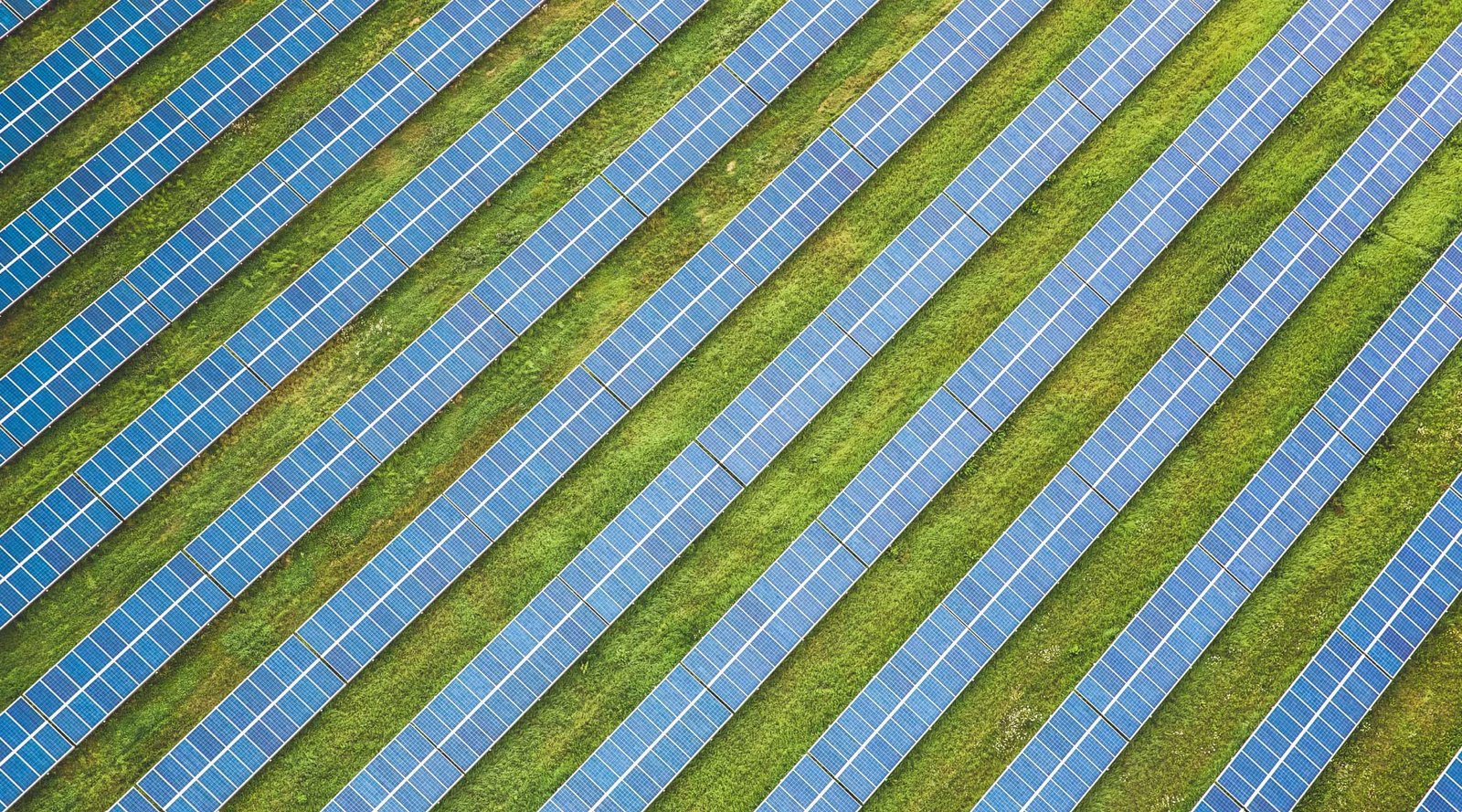

As Uganda strives to harness the power of solar energy and expand access to clean and sustainable electricity, it is essential to remove barriers that hinder the growth of the solar sector. One crucial step towards achieving this is exempting import taxes on solar products. By doing so, Uganda can foster solar adoption, drive economic growth, and enhance energy access, ultimately paving the way for a brighter and greener future.

Promoting Solar Energy: Solar power offers numerous benefits, including reduced greenhouse gas emissions, energy independence, and cost savings. By exempting import taxes on solar products, the Ugandan government can encourage the use of solar technologies, both at the individual and industrial levels. This proactive approach will facilitate the transition to clean energy and contribute to Uganda’s sustainable development goals.

Affordability and Accessibility: Import tax exemptions on solar products will significantly lower their cost, making them more affordable and accessible to a wider range of consumers. This will allow individuals, businesses, and communities to invest in solar solutions, such as solar panels, batteries, and solar water heaters, without facing excessive financial burdens. Increased affordability will lead to greater adoption and contribute to bridging the energy access gap in rural and underserved areas.

Job Creation and Economic Growth: The solar industry has significant potential to generate employment opportunities and stimulate economic growth. By exempting import taxes, Uganda can attract investments in the solar sector, spur local manufacturing and assembly of solar products, and create a thriving market for solar-related services. This will not only contribute to job creation but also enhance skills development, local entrepreneurship, and the growth of ancillary industries.

Clean Energy Transition: Exempting import taxes on solar products aligns with Uganda’s commitment to clean energy transition and its efforts to reduce reliance on fossil fuels. By facilitating the importation of solar technologies, the government can accelerate the deployment of renewable energy solutions, reduce carbon emissions, and mitigate the adverse impacts of climate change. This will contribute to a cleaner and healthier environment for present and future generations.

Capacity Building and Technology Transfer: By eliminating import taxes, Uganda can attract solar technology providers and encourage knowledge sharing and technology transfer. This collaboration will enable local stakeholders to acquire technical expertise, enhance manufacturing capabilities, and develop sustainable solar solutions tailored to Uganda’s specific needs. Building local capacity in the solar industry will not only foster self-reliance but also position Uganda as a regional leader in renewable energy development.

Collaborative Efforts: Exempting import taxes on solar products requires a collaborative approach involving the government, industry stakeholders, and international partners. It is crucial to engage in dialogue, establish clear guidelines, and ensure proper quality control measures to safeguard consumer interests. Continued collaboration will promote transparency, create a conducive investment environment, and drive sustainable solar adoption in Uganda.

Conclusion: Exempting import taxes on solar products is a vital step towards unlocking the potential of solar energy in Uganda. By reducing costs, improving affordability, and encouraging solar adoption, the government can stimulate economic growth, enhance energy access, and contribute to a cleaner and more sustainable future. Let us work together to harness the power of the sun, empower communities, and build a brighter Uganda powered by clean and renewable energy.